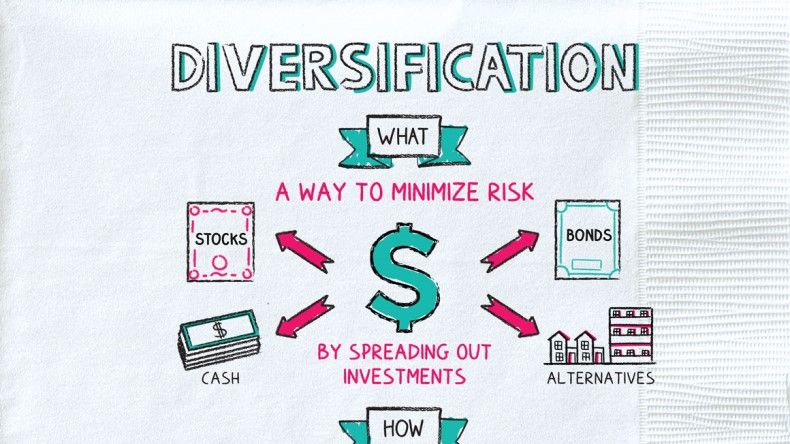

Diversification is an investing strategy used to manage risk. Rather than concentrate money in a single company, industry, sector, or asset class, investors diversify their investments across various companies, industries, and asset classes.

When you divide your funds across companies large and small, at home and abroad, in both stocks and bonds, you avoid the risk of having all of your eggs in one basket.

Why Do You Need Diversification?

You need diversification to minimize investment risk. If we had perfect knowledge of the future, everyone could choose one investment that would perform perfectly for as long as needed. Since the future is highly uncertain and markets constantly change, we diversify our investments among companies and assets that are not exposed to the same risks.

Diversification is not designed to maximize returns. At any given time, investors concentrating capital on a limited number of investments may outperform a diversified investor. Over time, a diversified portfolio generally outperforms the majority of more focused ones. This fact underscores the challenges of picking just a few winning investments.

One key to diversification is owning investments that perform differently in similar markets. For example, bond yields are generally falling when stock prices rise. Professionals would say stocks and bonds are negatively correlated. Even at the rare moments when stock prices and bond yields move in the same direction (both gaining or both losing), stocks typically have much greater volatility—which is to say they gain or lose much more than bonds.

While not every investment in a well-diversified portfolio will be negatively correlated, the goal of diversification is to buy assets that do not move in lockstep with one another.

Diversification Strategy

There are plenty of different diversification strategies to choose from, but their common denominator is buying investments in various asset classes. An asset class is nothing more than a group of investments with similar risk and return characteristics.

For example, stocks are an asset class, like bonds. Stocks can be further subdivided into asset classes of large-cap stocks and small-cap stocks, while bonds may be divided into asset classes like investment-grade bonds and junk bonds.

Stocks and Bonds

Stocks and bonds represent two of the leading asset classes. When it comes to diversification, one of the critical decisions investors make is how much capital to invest in stocks vs. bonds. Deciding to balance a portfolio more toward stocks vs. bonds increases growth at the cost of greater volatility. Bonds are less volatile, but growth is generally more subdued.

For younger retirement investors, a more significant allocation of money in stocks is generally recommended due to their long-term outperformance compared to bonds. As a result, a typical retirement portfolio will allocate 70% to 100% of assets to stocks.

As an investor nears retirement, shifting the portfolio toward bonds is common. While this change will reduce the expected return, it also reduces the portfolio’s volatility as a retiree begins to turn their investments into a retirement paycheck.

Industries and Sectors

Stocks can be classified by industry or sector, and buying stocks or bonds of companies in different industries provides solid diversification. For example, the S&P 500 consists of stocks of companies in 11 different industries:

- Communication Services

- Consumer Discretionary

- Consumer Staples

- Energy

- Financials

- Health Care

- Industrials

- Materials

- Real Estate

- Technology

- Utilities

During the Great Recession of 2007–2009, companies in the real estate and financial industries experienced significant losses. In contrast, the utilities and health care industries didn’t experience the same losses. Diversification by industry is another fundamental way of controlling investment risks.

Big Companies and Small Companies

History shows that the company’s size, as measured by market capitalization, is another source of diversification. Generally, small-cap stocks have higher risks and returns than more stable, large-cap companies. For example, a recent study by AXA Investment Managers found that small caps have outperformed large-cap stocks by a little over 1% a year since 1926.

Geography

The location of a company can also be an element of diversification. Generally speaking, locations have been divided into three categories: U.S. companies, companies in developed countries, and companies in emerging markets. As globalization increases, the diversification benefits based on location have been called into question.

The S&P 500 comprises companies headquartered in the U.S., yet their business operations span the globe. Nevertheless, some diversification benefits remain, as companies headquartered in other countries, particularly emerging markets, can perform differently than U.S.-based enterprises.

Growth and Value

Diversification can also be found by buying the stocks or bonds of companies at different stages of the corporate lifecycle. Newer, fast-growing companies have different risk and return characteristics than older, more established firms.

Companies that are rapidly growing their revenue, profits, and cash flow are called growth companies. These companies have higher valuations relative to reported earnings or book value than the overall market. Their rapid growth is used to justify their lofty valuations.

Value companies are those that are growing more slowly. They tend to be more established firms or companies in specific industries, such as utilities or financials. While their growth is slower, their valuations are also lower than the overall market.

Some believe that value companies outperform growth companies over the long run. At the same time, growth companies can outperform over long periods, as in the current market.

Bond Asset Classes

There are several different bond asset classes, although they generally fit into two classifications. First, they are classified by credit risk—the risk that the borrower will default. U.S. Treasury bonds have the least risk of default, while bonds issued by emerging market governments or companies with below investment grade credit have a much higher risk of default.

Second, bonds are classified by interest rate risk, the length of time until the bond matures. Bonds with longer maturities, such as 30-year bonds, have the highest interest rate risk. In contrast, short-term bonds with maturities of a few years or less have the slightest interest rate risk.

Alternative Asset Classes

Several asset classes do not fit neatly into the stock or bond categories. These include real estate, commodities, and cryptocurrencies. While alternative investments aren’t required to have a diversified portfolio, many investors believe that one or more alternative asset classes benefit from diversification while increasing the portfolio’s potential return.

Diversification with Mutual Funds

Creating a diversified portfolio with mutual funds is a simple process. Indeed, an investor can create a well-diversified portfolio with a single target date retirement fund. One can also create remarkable diversity with just three index funds in what is known as the 3-fund portfolio.

However one goes about diversifying a portfolio, it is an important risk management strategy. Not putting all of your eggs in one basket reduces the portfolio’s volatility while not sacrificing significant market returns.