What Is Keynesian Economics?

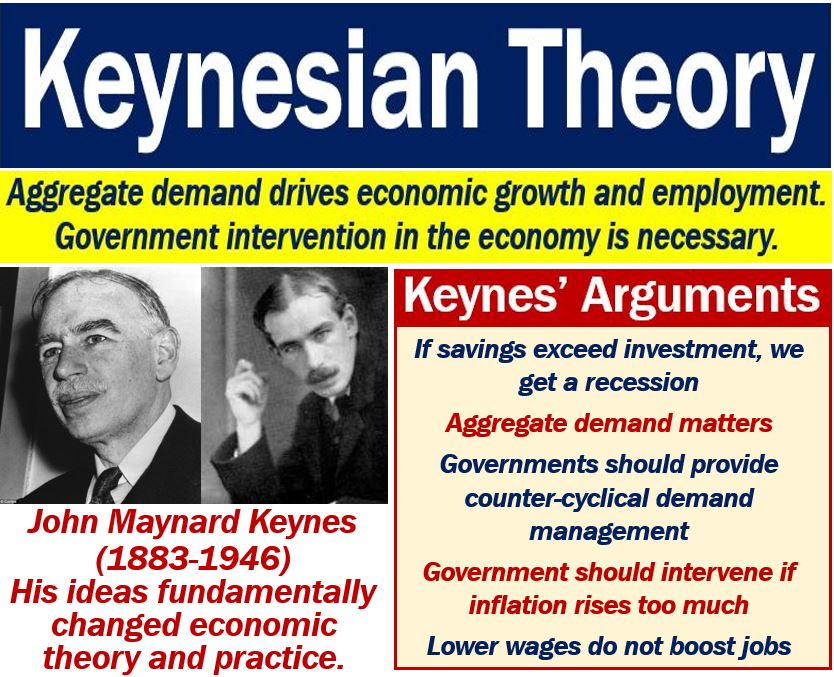

Keynesian economics is a macroeconomic theory of total spending in the economy and its effects on output, employment, and inflation. British economist John Maynard Keynes developed it during the 1930s to understand the Great Depression.

The central belief of Keynesian economics is that government intervention can stabilize the economy. Keynes’ theory was the first to sharply separate the study of economic behavior and individual incentives from analyzing broad aggregate variables and constructs.

Based on his theory, Keynes advocated for increased government expenditures and lower taxes to stimulate demand and pull the global economy out of the Depression. Subsequently, Keynesian economics was used to refer to the concept that optimal economic performance could be achieved—and economic slumps could be prevented—by influencing aggregate demand through government economic intervention. Keynesian economists believe that such intervention can achieve full employment and price stability.

KEY TAKEAWAYS

- Keynesian economics focuses on using active government policy to manage aggregate demand to address or prevent economic recessions.

- Keynes developed his theories in response to the Great Depression and was highly critical of previous economic views, which he referred to as classical economics.

- Keynesian economists recommend active fiscal and monetary policy as the primary tools for managing the economy and fighting unemployment.

Understanding Keynesian Economics

Keynesian economics represented a new way of looking at spending, output, and inflation. Previously, what Keynes dubbed classical economic thinking held that cyclical swings in employment and economic production create profit opportunities that individuals and entrepreneurs would be incentivized to pursue. In so doing, they correct the imbalances in the economy.

According to Keynes’ construction of this so-called classical theory, if aggregate demand in the economy fell, the resulting weakness in production and jobs would precipitate a decline in prices and wages. A lower level of inflation and wages would induce employers to make capital investments and employ more people, stimulating employment and restoring economic growth. Keynes believed, however, that the depth and persistence of the Great Depression severely tested this hypothesis.

In his book The General Theory of Employment, Interest and Money and other works, Keynes argued against his construction of classical theory, asserting that, during recessions, business pessimism and specific characteristics of market economies would exacerbate economic weakness and cause aggregate demand to plunge further.

For example, Keynesian economics disputes the notion held by some economists that lower wages can restore full employment because labor demand curves slope downward like any standard demand curve.

Similarly, poor business conditions may cause companies to reduce capital investment rather than take advantage of lower prices to invest in new plants and equipment. This also would have the effect of reducing overall expenditures and employment.

Keynes argued that employers would not add employees to produce goods that cannot be sold because demand for their products is weak.

Keynesian Economics and the Great Depression

Keynesian economics is sometimes referred to as “depression economics,” as Keynes’ General Theory was written during a time of deep depression—not only in his native United Kingdom but worldwide. Keynes’ understanding informed the famous 1936 book of events arising during the Great Depression, which Keynes believed could not be explained by classical economic theory as he portrayed it in his book.

Other economists had argued that, in the wake of any widespread downturn in the economy, businesses and investors taking advantage of lower input prices in pursuit of their self-interest would return output and costs to a state of equilibrium unless otherwise prevented from doing so. Keynes believed that the Great Depression seemed to counter this theory.

Output was low, and unemployment remained high during this time. The Great Depression inspired Keynes to think differently about the nature of the economy. From these theories, he established real-world applications that could have implications for a society in an economic crisis.

Keynes rejected the idea that the economy would return to a natural state of equilibrium. Instead, he argued that, once an economic downturn sets in, for whatever reason, the fear and gloom that it engenders among businesses and investors will tend to become self-fulfilling and can lead to a sustained period of depressed economic activity and unemployment.

In response to this, Keynes advocated a countercyclical fiscal policy in which, during periods of economic woe, the government should undertake deficit spending to make up for the decline in investment and boost consumer spending to stabilize aggregate demand.

Keynes was highly critical of the British government at the time. The government significantly increased welfare spending and raised taxes to balance the national books. Keynes said this would not encourage people to spend their money, leaving the economy unstimulated and unable to recover and return to a prosperous state.

Keynes proposed that the government spend more money and cut taxes to turn a budget deficit, increasing consumer demand in the economy. This would, in turn, lead to an increase in overall economic activity and a reduction in unemployment.

Keynes also criticized the idea of excessive saving unless it was for a specific purpose, such as retirement or education. He saw it as dangerous for the economy because the more money sitting stagnant, the less money is in the economy, stimulating growth. This was another of Keynes’ theories geared toward preventing deep economic depression.

Many economists have criticized Keynes’ approach. They argue that businesses responding to economic incentives will tend to return the economy to a state of equilibrium unless the government prevents them from doing so by interfering with prices and wages, making it appear as though the market is self-regulating.

On the other hand, Keynes, who was writing while the world was mired in a period of deep economic depression, was not as optimistic about the natural equilibrium of the market. He believed that the government was in a better position than market forces when creating a robust economy.

Keynesian Economics and Fiscal Policy

The multiplier effect, developed by Keynes’ student Richard Kahn, is one of the chief components of Keynesian countercyclical fiscal policy. According to Keynes’ theory of fiscal stimulus, an injection of government spending eventually leads to added business activity and even more spending. This theory proposes that spending boosts aggregate output and generates more income. If workers are willing to spend their extra income, the resulting growth in gross domestic product (GDP) could be even more significant than the initial stimulus amount.

The magnitude of the Keynesian multiplier is directly related to the marginal propensity to consume. Its concept is simple. Spending from one consumer becomes income for a business that then spends on equipment, worker wages, energy, materials, purchased services, taxes, and investor returns. That worker’s income can then be paid, and the cycle continues. Keynes and his followers believed that individuals should save less and spend more, raising their marginal consumption propensity to effect full employment and economic growth.

In this theory, one dollar spent in fiscal stimulus eventually creates more than one dollar in growth. This appeared to be a coup for government economists, who could justify politically popular spending projects on a national scale.

This theory was the dominant paradigm in academic economics for decades. Eventually, other economists, such as Milton Friedman and Murray Rothbard, showed that the Keynesian model misrepresented the relationship between savings, investment, and economic growth.6 Many economists still rely on multiplier-generated models, although most acknowledge that fiscal stimulus is far less effective than the original multiplier model suggests.

The fiscal multiplier commonly associated with the Keynesian theory is one of two broad economic multipliers. The other multiplier is known as the money multiplier. This multiplier refers to the money creation process resulting from a fractional reserve banking system. The money multiplier is less controversial than its Keynesian fiscal counterpart.

Keynesian Economics and Monetary Policy

Keynesian economics focuses on demand-side solutions to recessionary periods. Government intervention in economic processes is integral to the Keynesian arsenal for battling unemployment, underemployment, and low economic demand. The emphasis on direct government intervention in the economy often places Keynesian theorists at odds with those who argue for limited market involvement.

Wages and employment, Keynesians argue, are slower to respond to the needs of the market and require government intervention to stay on track. Furthermore, they argue prices do not react quickly and change only gradually when monetary policy interventions are made, giving rise to a branch of Keynesian economics known as monetarism.

If prices are slow to change, it is possible to use the money supply as a tool and adjust interest rates to encourage borrowing and lending. Lowering interest rates is one way governments can meaningfully intervene in economic systems, encouraging consumption and investment spending. Short-term demand increases initiated by interest rate cuts reinvigorate the financial system and restore employment and service demand. The new economic activity then feeds continued growth and employment.

Keynesian theorists argue that economies do not stabilize themselves very quickly and require active intervention that boosts short-term demand in the economy.

Keynesian theorists believe this cycle is disrupted without intervention, and market growth becomes more unstable and prone to excessive fluctuation. Keeping interest rates low is an attempt to stimulate the economic cycle by encouraging businesses and individuals to borrow more money. They then spend the money that they borrow. This new spending stimulates the economy. Lowering interest rates, however, does not always lead directly to economic improvement.

Monetarist economists focus on managing the money supply and lowering interest rates to solve economic woes, but they generally try to avoid the zero-bound problem. As interest rates approach zero, stimulating the economy by lowering interest rates becomes less effective because it reduces the incentive to invest rather than hold money in cash or close substitutes like short-term Treasurys. Interest rate manipulation may no longer be enough to generate new economic activity if it can’t spur investment, and the attempt at generating economic recovery may stall completely. This is a type of liquidity trap.

When lowering interest rates fails to deliver results, Keynesian economists argue that other strategies must be employed, primarily fiscal policy. Other interventionist policies include direct control of the labor supply, indirectly changing tax rates to increase or decrease the money supply, changing monetary policy, or placing controls on the supply of goods and services until employment and demand are restored.

Keynesian Economics and the 2007-08 Financial Crisis

In response to the Great Recession and financial crisis of 2007–2008, the Congress and Executive branch undertook several measures that drew from Keynesian economic theory. The federal government bailed out debt-ridden companies in several industries, including banks, insurers, and automakers. It also took into conservatorship Fannie Mae and Freddie Mac, the two major market makers and guarantors of mortgages and home loans.

In 2009, President Obama signed the American Recovery and Reinvestment Act, an $831-billion government stimulus package designed to save existing jobs and create new ones. It included tax cuts/credits, family unemployment benefits, and earmarked healthcare, infrastructure, and education expenditures.

These stimulus measures and federal interventions helped America’s economy recover, preventing the Great Recession from becoming another full-blown depression.

COVID-19 Stimulus

In the wake of the COVID-19 pandemic starting in early 2020, the U.S. government, under President Donald Trump and then President Joseph Biden, offered a variety of relief, loan forgiveness, and loan extension programs.

The U.S. government also supplemented weekly state unemployment benefits and sent American taxpayers direct aid through three separate, tax-free stimulus checks.

Who Was John Maynard Keynes?

John Maynard Keynes (1883–1946) was a British economist who was the founder of Keynesian economics and the father of modern macroeconomics. Keynes studied at one of the most elite schools in England, the King’s College at Cambridge University, earning an undergraduate degree in mathematics from the latter in 1905. He excelled at math but received almost no formal training in economics.

How Does Keynesian Economics Differ From Classical Economics?

According to Keynes, classical economics holds that swings in employment and economic output create profit opportunities that individuals and entrepreneurs are incentivized to pursue, eventually correcting economic imbalances. In contrast, Keynes argued that, during recessions, business pessimism and specific characteristics of market economies would exacerbate economic weakness and cause aggregate demand to plunge further. Keynesian economics holds that, during periods of economic woe, governments should undertake deficit spending to make up for the decline in investment and boost consumer spending to stabilize aggregate demand.

What Is Monetarism?

Monetarism is a macroeconomic theory stating that governments can foster economic stability by targeting the growth rate of the money supply. Closely associated with economist Milton Friedman, monetarism is a branch of Keynesian economics that emphasizes the use of monetary policy over fiscal policy to manage aggregate demand, which contrasts with the theories of most Keynesian economists.

The Bottom Line

John Maynard Keynes and Keynesian economics were revolutionary in the 1930s and did much to shape post-World War II economies in the mid-20th century. His theories came under attack in the 1970s, saw a resurgence in the 2000s, and are still debated today. Keynesian economics recognizes the role of government finance in sparking aggregate demand. Federal spending and tax cuts leave more money in people’s pockets, which can stimulate demand and investment. Unlike free market economists, Keynesian economics welcomes limited government intervention and stimulus during a recession.