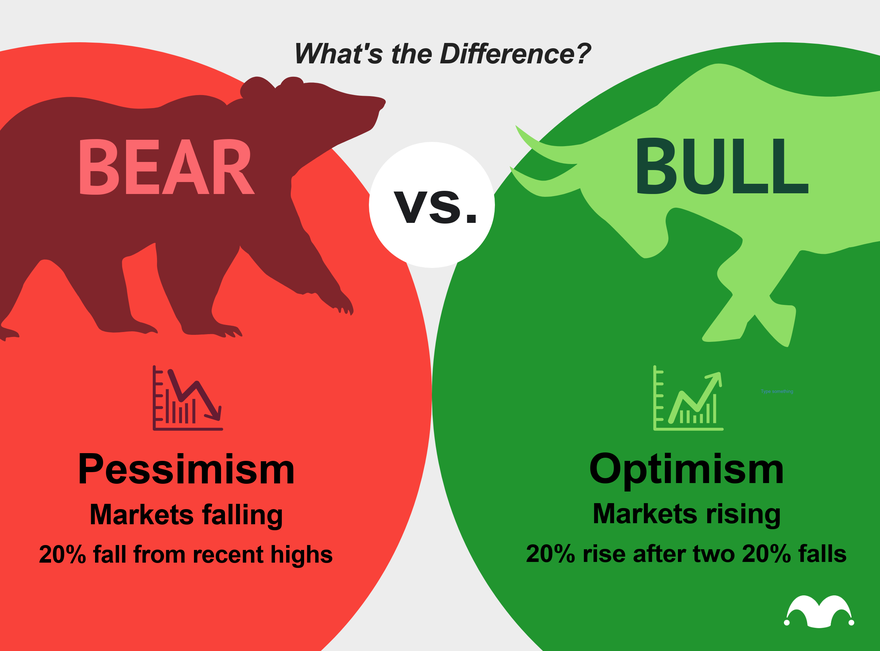

Move over, Scorpios and Capricorns. Regarding the stock market, there are two signs to consider: the bull and the bear. In stock market parlance, a bear market means stocks are down 20% or more, while a bull signals the market is up significantly. Both are a part of the stock market’s lifecycle: You’ll see your fair share of each, and knowing what to expect can help you handle your investment decisions.

What Is a Bear Market?

A bear market is when stock prices on major market indexes, like the S&P 500 or Dow Jones industrial average (DJIA), fall by at least 20% from a recent high. This is in contrast to a market correction, which is a fall of at least 10% and tends to be much shorter lived. Corrections generally don’t lead to full bear markets. But when they do, the bear market results in an average decline of 32.5% from the market’s most recent high.

A bear market is often caused by a slowing economy and rising unemployment rates. During this period, investors generally feel pessimistic about the stock market’s outlook, and a recession may accompany the changes in the stock market. But a bear market doesn’t always indicate that a recession is coming. In recent history, a recession has followed a bear market about 70% of the time.

During a bear market, many investors may want to sell their investments to protect their money, get access to cash or move their holdings to more conservative securities, which can have the unintended side effect of creating a sell-off, which makes stock prices fall even lower. It may also cause investors to sell their investments for less than they paid, which can hinder their ability to reach their long-term financial goals.

While bear markets have become less frequent overall since World War II, they still happen about once every 5.4 years. You can expect to live through approximately 14 bear markets during your lifetime.

How Long Does a Bear Market Last?

Historically, bear markets tend to be shorter than bull markets. The average length of a bear market is just 289 days or just under 10 months.

Some bear markets have lasted for years, while others only ran for a few months. The longest bear market occurred from March 1937 until April 1942—The Great Depression—and lasted 61 months. In recent decades, bear markets have generally gotten shorter in length, though. In 1990, for example, a bear market lasted for just three months.

Since World War II, the stock market has taken about two years to recover or reach its previous high. But that isn’t always the case. The most recent bear market, which started in March 2020, was concise, ending in August when stocks closed at record highs. The previous bear market, the Great Recession, on the other hand, didn’t see a recovery for about four years.

It’s important to note that the stock market can see significant gains even during bear markets. For instance, over half of the S&P 500’s most muscular days happened during bear markets in the last two decades.

What Is a Bull Market?

A bull market is when a primary stock market index rises at least 20% from a recent low. With a bull market, stock prices steadily increase, and investors are optimistic and encouraged about the stock market’s future performance.

Bull markets indicate that the economy is strong and unemployment rates are generally low, which can instill investors with even more confidence and provide people with more income to invest in. This can result in massive growth: Stock prices go up 112% on average during bull markets.

How Long Does a Bull Market Last?

Bull markets can last a few months to several years, but they tend to be longer than bear markets. They also tend to be more frequent: Bull markets have occurred for 78% of the past 91 years.

The average bull market lasts 973 days or 2.7 years. The longest bull market lasted from 2009 to 2020 and resulted in more than 400% stock growth.

What Should You Do in a Bull or a Bear Market?

While bull markets generally don’t cause people too much stress, bear markets often inspire anxiety and uncertainty. However, how you should handle a bear market depends on your investment timeline.

If You’re Decades Away from Your Goal

If you are in your 20s, 30s, or even your 40s and are investing for a far-off goal, like retirement, strive to hold onto your stocks and keep investing during any market. If you’re investing in a diversified portfolio, you crafted your investment strategy and holdings with both bull and bear markets.

While you may be tempted to sell off your investments to avoid losing more money during a bear market, doing so locks in the losses you’ve experienced. You then have the difficult decision of figuring out when to reenter the stock market.

Market timing is notoriously tricky, and you never know when the market will hit its bottom. If you move your investments to cash for just a month while trying to figure out if the market has reached its lowest, you could cut your investment returns by over 30% compared to someone who stays invested the whole time, according to research by Charles Schwab.

Instead, look at bear markets as opportunities: While you’re young, a bear market gives you the chance to take advantage of lower stock prices before recovery occurs. And if you practice dollar-cost-averaging—where you invest in security at regular intervals rather than with a one-time lump sum—you decrease the risk of paying more than you otherwise might per share. You may wind up paying less per share overall.

While you should try not to sell during a downturn, a bear market may also provide a reminder to revisit your investment strategy once the market recovers. Even though you know a market recovery will happen, you may realize that your willingness to take on risk is less than you thought.

If You’re Nearing Your Goal

If you’re approaching the end of your investment timeline (a.k.a. you’re a few years away from your target retirement date), you have less time to recover from bear market dips. While we know the market historically has recovered from each bear market, you may not have the average of two years for your investments to return to their previous values.

That’s why financial advisors recommend you revisit your portfolio many times over your life to adjust your portfolio allocation and rebalance it as needed. That may mean buying or selling different securities to maintain an appropriate mix of stocks, bonds, and cash to meet your financial objectives and risk tolerance.

If you’re unsure how to rebalance your portfolio appropriately to match your timeline and willingness to take on financial risk, check out our guide to retirement savings here. You may also want to consult a financial advisor to ensure you have the proper diversification and investment mix.

If You’re Retired

Once they no longer have an active income stream, many people shift their investment strategies to preservation instead of growth. That generally means making your investments more conservative, or cash-, bond- and fixed-income-based, than before.

Actively withdrawing from a finite nest egg also introduces a new risk: during down markets or periods of high inflation, you withdraw more than you can afford and run out of money. You can combat this concern with a withdrawal rule called the 4% Rule.

The 4% Rule states that you can safely withdraw 4% of your retirement portfolio the first year you retire. Then you can safely withdraw the same based amount each year, adjusted for inflation, without running out of money for at least 30 years and sometimes up to 50. Notably, the research that established the 4% Rule found this true through both bull and bear markets.

If you’re particularly concerned about stock market returns in retirement, you might opt for withdrawing only 3% of your portfolio. A financial advisor or tax expert can help you determine your assets’ correct asset and risk tolerance withdrawal rate.

The Bottom Line on Investing Through Bear and Bull Markets

While bear markets can be scary, they are a natural part of the economic cycle and often lead to even more substantial market returns. A diversified portfolio constructed for your financial goals can prepare you to stay the course and weather any kind of market confidently.