What Is Collateral?

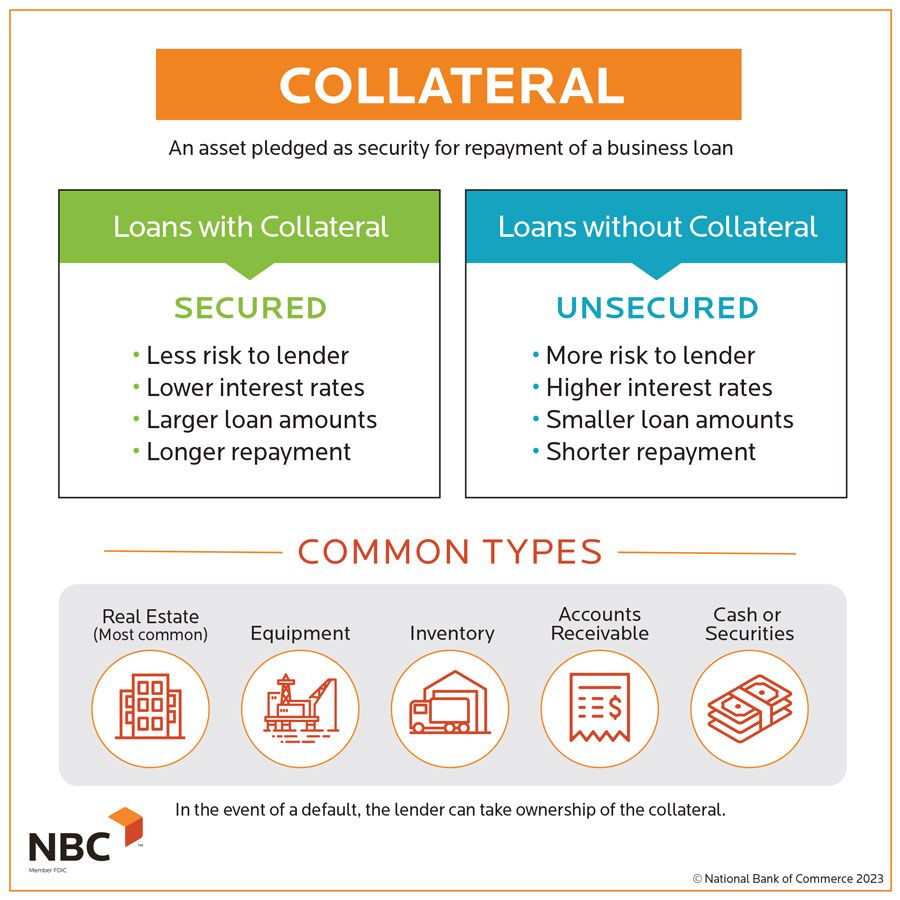

Collateral in the financial world is a valuable asset that a borrower pledges as security for a loan.

For example, when a homebuyer obtains a mortgage, the home serves as the collateral for the loan. For a car loan, the vehicle is the collateral. A business that obtains financing from a bank may pledge valuable equipment or real estate owned by the business as collateral for the loan. In the event of a default, the lender can seize the collateral and sell it to recoup the loss.

Other assets can collateralize other nonspecific personal loans. For instance, a secured credit card may be secured by a cash deposit for the same amount of the credit limit—$500 for a $500 credit limit.

KEY TAKEAWAYS

- Collateral is an item of value pledged to secure a loan.

- Collateral reduces the risk for lenders.

- If a borrower defaults on the loan, the lender can seize and sell the collateral to recoup its losses.

- Mortgages and car loans are two types of collateralized loans.

- Other personal assets, such as a savings or investment account, can be used to secure a collateralized personal loan.

How Collateral Works

Before a lender issues you a loan, it wants to know that you have the ability to repay it. That’s why many of them require some form of security. This security is called collateral, which minimizes the risk for lenders by ensuring that the borrower keeps up with their financial obligation. The borrower has a compelling reason to repay the loan on time because if they default, they will lose their home or other assets pledged as collateral.

Loans secured by collateral are typically available at substantially lower interest rates than unsecured loans. A lender’s claim to a borrower’s collateral is called a lien—a legal right or claim against an asset to satisfy a debt.

If the borrower does default, the lender can seize the collateral and sell it, applying the money it gets to the unpaid portion of the loan. The lender can choose to pursue legal action against the borrower to recoup any remaining balance.

Types of Collateral

The loan type often predetermines the nature of the collateral. When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include cars—only if they are paid off in full—bank savings deposits and investment accounts. Retirement accounts are not usually accepted as collateral.

You may also use future paychecks as collateral for very short-term loans, not just from payday lenders. Traditional banks offer such loans, usually for terms no longer than a couple of weeks. These short-term loans are an option in a genuine emergency, but even then, you should read the fine print carefully and compare rates.

Collateralized Personal Loans

Another type of borrowing is the collateralized personal loan, in which the borrower offers an item of value as security for a loan. The value of the collateral must meet or exceed the amount being loaned. If you are considering a collateralized personal loan, your best choice for a lender is probably a financial institution that you already do business with, especially if your collateral is your savings account. If you already have a relationship with the bank, that bank would be more inclined to approve the loan, and you are more apt to get a decent rate for it.

IMPORTANT

- Use a financial institution with which you already have a relationship if you’re considering a collateralized personal loan.

Examples of Collateral Loans

Residential Mortgages

A mortgage is a loan in which the house is the collateral. If the homeowner stops paying the mortgage for at least 120 days, the loan servicer can begin legal proceedings, leading to the lender eventually taking possession of the house through foreclosure.1 Once the property is transferred to the lender, it can be sold to repay the remaining principal on the loan.

Home Equity Loans

A home may also function as collateral on a second mortgage or home equity line of credit (HELOC). In this case, the loan amount will not exceed the available equity. For example, if a home is valued at $200,000, and $125,000 remains on the primary mortgage, a second mortgage or HELOC will be available only for as much as $75,000.

Margin Trading

Collateralized loans are also a factor in margin trading. An investor borrows money from a broker to buy shares, using the balance in the investor’s brokerage account as collateral. The loan increases the number of shares the investor can buy, thus multiplying the potential gains if the shares increase in value. But the risks are also multiplied. If the shares decrease in value, the broker demands payment of the difference. In that case, the account is collateral if the borrower fails to cover the loss.

Is Collateral Property?

Collateral guarantees a loan, so it must be an item of value. For example, it can be a piece of property, such as a car or a home, or even cash that the lender can seize if the borrower does not pay.

What Loans Do not Use an Asset as Collateral?

If you don’t have any collateral necessary to secure a certain type of loan, you may want to consider looking into unsecured loans, such as a personal loan or credit card (both of which don’t use an asset as collateral), as an alternative.

Do I Get Back My Collateral?

If you have any assets being used as collateral on a loan and don’t miss any payments, you won’t lose your collateral. However, if you fail to make payments on time and ultimately default on your loan, the collateral can be seized and sold, with the profits being used to pay off the remainder.

The Bottom Line

You risk losing your collateral if you fail to pay back your debt. So to ensure you keep your car, home, or any other valuable asset being used as collateral on a loan, always make your payments on time to minimize any possibility of defaulting on your debt.

- Consumer Financial Protection Bureau. “1024.41 Loss Mitigation Procedures.”

Note: ZPEnterprises is not a licensed investor/financial advisor, but we are trying to share awareness of financial topics. Please do further research and work with a licensed financial advisor.