What Is an Interest Expense?

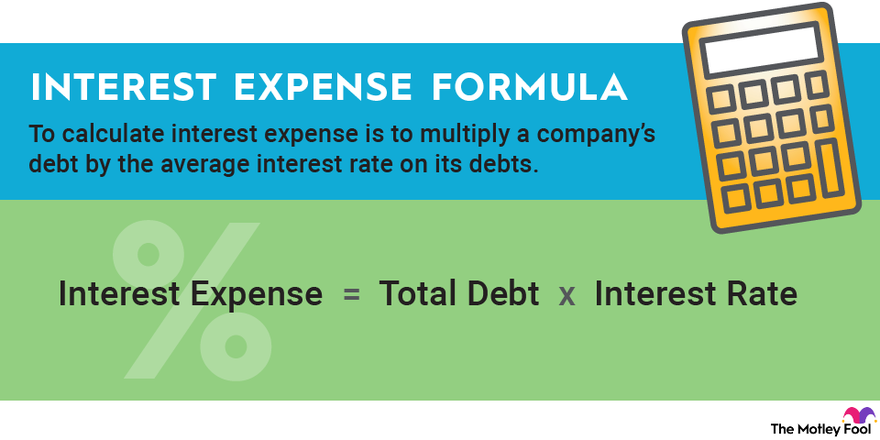

An interest expense is the cost incurred by an entity for borrowed funds. Interest expense is a non-operating expense shown on the income statement. It represents interest payable on any borrowings—bonds, loans, convertible debt, or lines of credit. It is essentially calculated as the interest rate times the outstanding principal amount of the debt. Interest expense on the income statement represents interest accrued during the period covered by the financial statements, not the interest paid over that period. While interest expense is tax-deductible for companies, in an individual’s case, it depends on their jurisdiction and also on the loan’s purpose.

For most people, mortgage interest is the single-biggest category of interest expense over their lifetimes, as interest can total tens of thousands of dollars over the life of a mortgage, as illustrated by online calculators.

How Interest Expenses Work

Interest expense often appears as a line item on a company’s balance sheet since there are usually differences in timing between interest accrued and interest paid. If interest has been accrued but has not yet been paid, it would appear in the “current liabilities” section of the balance sheet. Conversely, if interest has been paid in advance, it would appear as a prepaid item in the “current assets” section.

While mortgage interest is tax-deductible in the United States,1 it is not tax-deductible in Canada. The loan’s purpose is also critical in determining the tax-deductibility of interest expense. For example, if a loan is used for bona fide investment purposes, most jurisdictions would allow the interest expense for this loan to be deducted from taxes. However, there are restrictions even on such tax deductibility. In Canada, for instance, if the loan is taken out for an investment that is held in a registered account—such as a Registered Retirement Savings Plan (RRSP), Registered Education Savings Plan (RESP), or Tax-Free Savings Account—interest expense is not permitted to be tax-deductible.2

The amount of interest expense for companies with debt depends on the broad level of interest rates in the economy. Interest expense will be higher during rampant inflation since most companies will have incurred debt that carries a higher interest rate. On the other hand, during periods of muted inflation, interest expense will be on the lower side.

The amount of interest expense has a direct bearing on profitability, especially for companies with a huge debt load. Heavily indebted companies may have difficulty serving their debt loads during economic downturns. At such times, investors and analysts pay particularly close attention to solvency ratios such as debt to equity and interest coverage.

KEY TAKEAWAYS

- An interest expense is an accounting item that is incurred due to servicing debt.

- Interest expenses are often given favorable tax treatment.

- For companies, the more significant the interest expense, the greater the potential impact on profitability. Coverage ratios can be used to dig deeper.

Interest Coverage Ratio

The interest coverage ratio is defined as the ratio of a company’s operating income (or EBIT—earnings before interest or taxes) to its interest expense. The ratio measures a company’s ability to meet the interest expense on its debt with its operating income. A higher ratio indicates that a company has a better capacity to cover its interest expense.

For example, a company with $100 million in debt at 8% interest has $8 million in annual interest expense. If the annual EBIT is $80 million, then its interest coverage ratio is 10, which shows that the company can comfortably meet its obligations to pay interest. Conversely, if EBIT falls below $24 million, the interest coverage ratio of fewer than three signals that the company may have difficulty staying solvent, as an interest coverage of fewer than three times is often seen as a “red flag.”

- Internal Revenue Service. “Topic No. 505 Interest Expense.”

- Government of Canada. “Income Tax Folio S3-F6-C1, Interest Deductibility.”