A 401(k) is an employer-sponsored retirement plan. If you get a 401(k) account as part of your benefits package, you may choose to contribute a portion of your salary to the account, subject to annual limitations. Your employer may even match a portion of your contributions. The money you save is invested in the stock market and grows over the years to provide you with income in retirement.

How Does a 401(k) Work?

A 401(k) is a defined contribution plan, meaning that employees decide how much to contribute to their account. The unintuitive name “401(k)” comes from the section of the Internal Revenue Code that governs the plans. Employers offer two kinds of 401(k) accounts: Traditional 401(k)s and Roth 401(k)s.

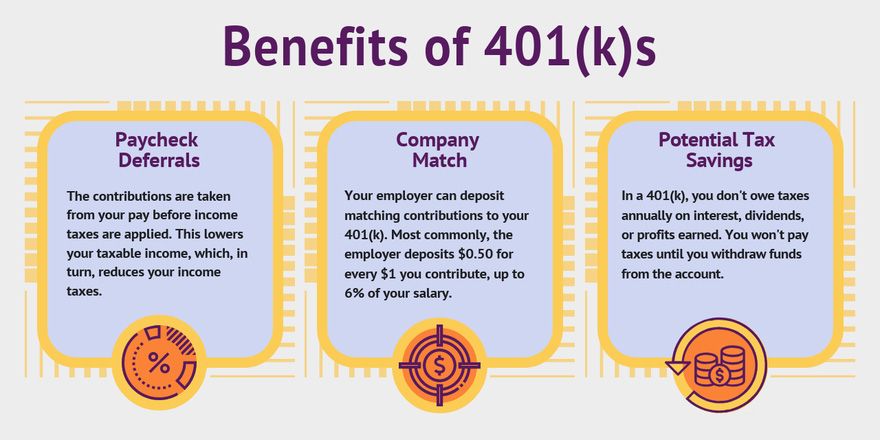

Contributions to a traditional 401(k) plan are taken out of your paycheck before income taxes are calculated. This means that contributions help lower your taxable income immediately. The contributions are invested in mutual funds and other investments and grow in value over time. When you take money out of your traditional 401(k) in retirement, you pay ordinary income tax on the withdrawals.

Roth 401(k)

With a Roth 401(k), contributions come from your after-tax income, meaning they do not reduce your taxable income. Like a Roth individual retirement account (IRA), you pay no income taxes on qualified distributions, such as those made after 59 ½—assuming you’ve held the account for five years. Choosing a Roth 401(k) can make sense if you believe you will be in a higher tax bracket when you retire than you are today. Lower-income and tax brackets could make a Roth 401(k) an excellent choice for many young earners just beginning their careers.

Nothing is forcing you to choose between either a traditional 401(k) or a Roth 401(k)—you can make contributions to both kinds of 401(k) plans if your employer offers them. Consider speaking with a tax professional or a financial advisor when deciding between a traditional or a Roth 401(k), or dividing your contributions between both types.

401(k) Contributions

You decide how much of your income to contribute to a 401(k) account every year, subject to IRS limits. Generally, you elect to save a percentage of your annual salary in your employer’s 401(k) when you start a new job, and you can adjust your contribution level up or down as often as the plan rules allow. You may halt contributions entirely at any time, for any reason.

Let’s say your bi-monthly paycheck is $2,000, and you chose to contribute 5 percent of your annual salary to the company’s traditional 401(k) plan. In this case, $100 would be subtracted from each paycheck and deposited in your 401(k) account. Your taxable income would be $1,900 (assuming no other pre-tax deductions). If you opted for a Roth 401(k), the $100 would be taken out of each paycheck after taxes.

Depending on your employer’s plan, you may be automatically enrolled in a 401(k) plan at a set contribution rate when you start a job unless you choose to opt-out of the plan. Alternatively, you may need to choose whether to enroll in your employer’s 401(k) plan or opt-out.

Annual 401(k) Contribution Limits

For 2021, the maximum an employee can contribute to a 401(k) is $19,500. If you’re 50 or older, you can deposit an extra $6,500 in catch-up contributions for a combined contribution of $26,000. For 2022, the maximum employee contribution is $20,500, plus an extra $6,500 if you’re 50 or older, for a combined total of $27,000. These limits apply to all 401(k) contributions, even if you split them between pre-tax and Roth contributions or you have two employers in a year and thus two separate 401(k) accounts.

| 2021 Limit | 2022 Limit | |

|---|---|---|

| Maximum Employee Contribution | $19,500 | $20,500 |

| Catch-Up Contributions for those 50 or Older | $6,500 | $6,500 |

About a fifth of employers also allows after-tax, non-Roth contributions. In such cases, a combined employee and employer contribution limit applies. In other words, your employer’s contributions, combined with your pre-tax, Roth, and after-tax contributions, can’t exceed this limit.

For 2021, that combined limit is $58,000, or $64,500 for those 50 or older. For 2022, the total limit rises to $61,000 or $67,500 for those 50 or older. Unlike Roth contributions, these extra after-tax savings grow tax-deferred but not tax-free.

Total 401(k) Employer and Employee Annual Contribution Limits

| 2021 | 2022 | |

|---|---|---|

| 401(k) Employee & Employer Contributions | $58,000 | $61,000 |

| Total with Catch-Up Contributions for those 50 or Older | $64,500 | $67,500 |

The contribution limits are updated annually, so checking in yearly is essential to see whether you can increase your contributions.

How Do Employer 401(k) Matching Contributions Work?

Some employers offer to match their employees’ 401(k) contributions to a certain percentage of their salary. One common approach involves an employer matching employee contributions dollar-for-dollar up to a total amount equal to 3 percent of their salary. Another famous formula is a $0.50 employer match for every dollar an employee contributes, up to 5 percent of their salary.

Continuing our example from above, consider the impact on your 401(k) savings of a dollar-for-dollar employer match, up to 3 percent of your salary. If you contribute 5 percent of your annual pay and receive $2,000 every pay period, with each paycheck, you would be contributing $100, and your employer would contribute $60.

When starting a new job, determine whether your employer provides matching 401(k) contributions and how much you need to contribute to maximizing the match. If they do, you should, at a minimum, set your 401(k) contribution level to obtain the entire match. Otherwise, you’re leaving free money on the table.

401(k) matching contributions and vesting

Some employers grant 401(k) matching contributions that vest over time. Under a vesting schedule, you gradually take ownership of your employer’s matching contributions over several years. If you remain with the company for the entire vesting period, you are said to be “fully vested” in your 401(k) account.

Employers impose a vesting schedule to incentivize employees to remain with the company.

For example, imagine that 50% of your employer’s matching contributions vest after you’ve worked for the company for two years, and you become fully vested after three years. If you were to leave the company and take a new job after two years, you would pass up owning half of the matching contributions pledged by your employer.

Remember, however, that you always maintain full ownership of your 401(k) contributions. Vesting only involves the employer’s matching contributions.

Choosing Investments in Your 401(k)

You will usually have several investment options in your 401(k) plan. The plan administrator provides participants different mutual funds, index funds, and sometimes exchange-traded funds (ETFs).

You can decide how much of your 401(k) balance to invest in different funds. You could opt to invest 70 percent of your contributions in an equity index fund, 20 percent in a bond index fund, and 10 percent in a money market mutual fund, for example.

Plans that automatically enroll workers almost always invest their contributions in what is known as a target-date fund. That’s a fund that holds a mix of stocks and bonds, with the mix determined by your current age and your “target” date for retirement. Generally, the younger you are, the higher the percentage of stocks. You are always free to change your investments even if you are automatically enrolled in a target-date fund.

Investing options available in 401(k) plans vary widely. You should consider consulting with a financial adviser to help determine your best investment strategy based on your risk tolerance and long-term goals.

Withdrawing funds from your 401(k)

Funds saved in a 401(k) are intended to provide you with income in retirement. IRS rules prevent you from withdrawing funds from a 401(k) without penalty until you reach age 59 ½. With a few exceptions (see below), early withdrawals before this age are subject to a tax penalty of 10% of the amount withdrawn, plus a 20% mandatory income tax withholding of the amount withdrawn from a traditional 401(k).

After you turn 59 ½, you can choose to begin taking distributions from your account. You must begin withdrawing funds from your 401(k) at age 72 (or age 70 ½ if you were born before June 30, 1949—the SECURE act increased this age threshold), as required minimum distributions (RMDs).

How do 401(k) require minimum distributions (RMDs) work?

Holders of traditional 401(k)s and Roth 401(k)s are required to take RMDs. The amount of your RMDs is based on your age and the balance in your account. As the name suggests, an RMD is a minimum—you can withdraw as much as you wish from the account each year, either in one lump sum or in a series of staggered withdrawals. As noted above, RMDs from a traditional 401(k) are included in your taxable income, while RMDs from Roth 401(k)s are not.

How to avoid 401(k) early withdrawal penalties

Certain exceptions allow you to take early withdrawals from your 401(k) and avoid the 10% early withdrawal tax penalty if you aren’t yet age 59 ½. Some of these include:

• Medical expenses that exceed 10% of your adjusted gross income

• Permanent disability

• Certain military service

• If you leave your employer at age 55 or older

• A “Qualified Domestic Retirement Order” issued as part of a divorce or court-approved separation.

Even if you can escape the additional 10% tax penalty, you still have to pay taxes on your withdrawal from a traditional 401(k). (In the case of a distribution paid to an ex-spouse under a QDRO, the 401(k) owner owes no income tax, and the recipient can defer taxes by rolling the distribution into an IRA.)

401(k) Loans

Some 401(k) plans let you borrow against your savings via a so-called 401(k) loan. It’s possible to borrow up to $50,000 or 50% of your vested balance, whichever is less. You generally have five years to repay your loan, and you’ll be charged interest and origination fees—although the interest goes back into your 401(k).

If you fail to pay back the loan after five years, the IRS considers it a distribution, subject to taxes and that 10 percent tax penalty. If you leave your job or lose it, the plan sponsor may require the employee to repay the outstanding balance immediately, and if you don’t, the sponsor will report it to the IRS as a distribution. However, you have until October of the following year—the due date of your tax return with extensions–to deposit the loan balance in an IRA and avoid owing any immediate tax or penalty.

What happens to your 401(k) when you change jobs?

When you change jobs, you have several options for your 401(k) balance. Avoid simply cashing out your savings—if you’re under 59½ years old, you’ll get hit with the 10 percent early withdrawal tax penalty, and if it’s a traditional 401(k) you’ll own income tax on the balance.

If you have less than $1,000 in your 401(k), the plan administrator is empowered to write you a check for the balance. This gives you 60 days to reinvest the money in an IRA or your new company’s 401(k) plan before you are subject to the additional 10% tax penalty and possible ordinary income tax. If you have more than $1,000 but less than $5,000 in your 401(k), the administrator can open an IRA in your name and roll your balance into it.

Leave your 401(k) with your old employer.

Some 401(k) plans let you leave your money right where it is after you leave the company. However, as your career progresses, you must keep track of multiple 401(k) accounts. Some employers require you to withdraw or roll over your 401(k) within a set period after you’ve left your job.

Move your 401(k) into your new employer’s plan.

Sometimes, you can roll your old 401(k) balance into your new employer’s plan, although not all plans allow this. Find out from your new employer whether they accept a trustee-to-trustee transfer of funds and how to handle the move. Make sure you understand the tax treatment of your 401(k) balances. Make sure that traditional 401(k) funds are rolled into a traditional 401(k) and Roth funds end up in a Roth account.

Roll your 401(k) balance into IRA

Another possibility is for you to roll the balance over into an IRA. When moving the money, make sure you initiate a trustee-to-trustee transfer rather than withdrawing the funds and depositing them into a new IRA. Many IRA custodians allow you to open a new account and designate it as a rollover IRA, so you don’t have to worry about contribution limits or taxes. When rolling your 401(k) balance into an IRA, make sure you place traditional 401(k) funds in a traditional IRA and Roth funds in a Roth IRA.