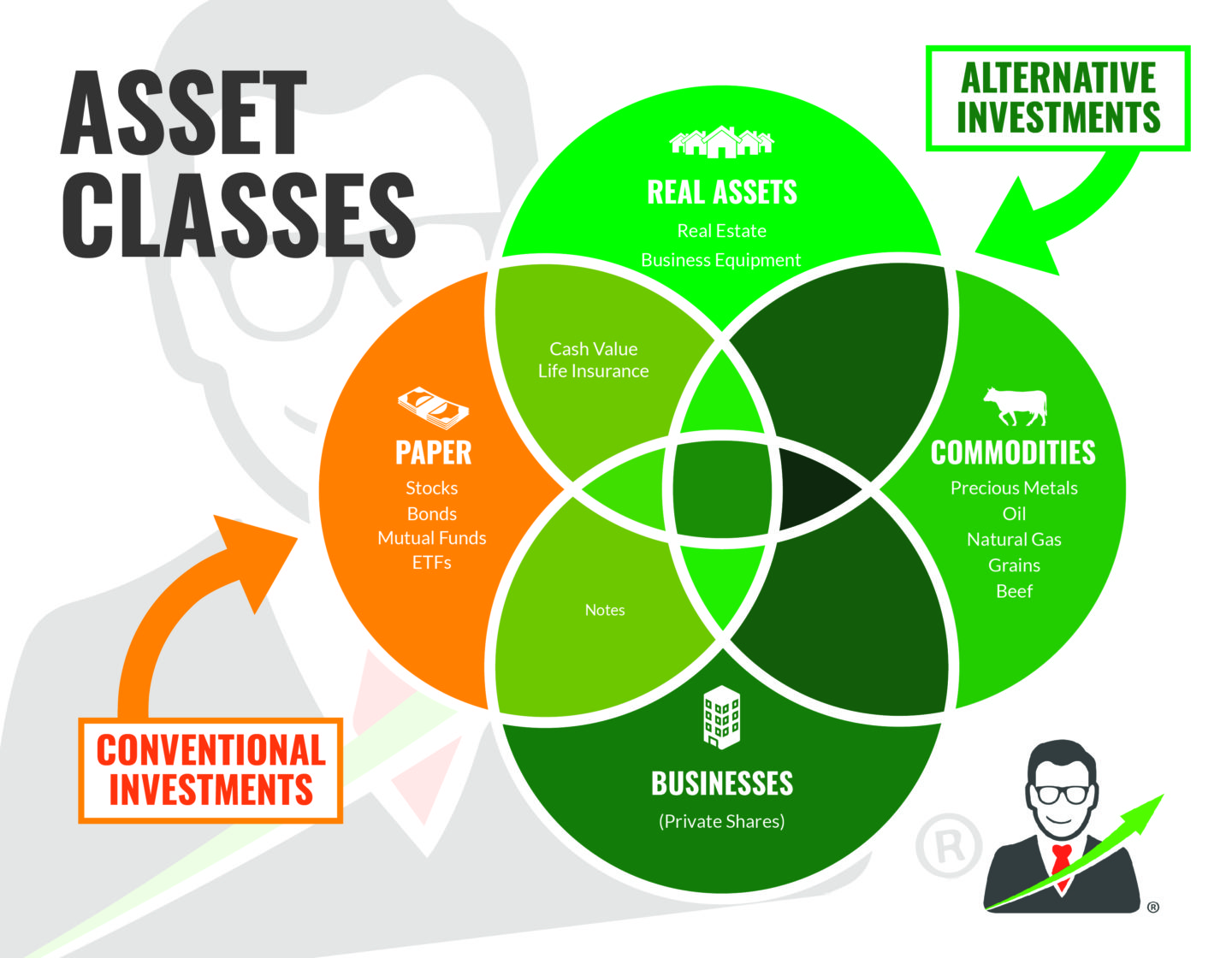

When dealing with investments, it’s essential to understand the different asset classes and which investments fall into each. An asset class is a collection of similar investments—including how they behave in the marketplace, the purchasing process, and how the government regulates them. Historically, there have been three primary asset classes, but today financial professionals generally agree that there are four broad classes of assets:

- Equities (stocks)

- Fixed-income and debt (bonds)

- Money market and cash equivalents

- Real estate and tangible assets

If your portfolio includes investments spread across the four asset classes, it’s considered balanced, which is ideal because it helps to reduce risk while maximizing return. If your portfolio is heavily concentrated in a limited number of sectors and those sectors underperform, your portfolio will take a significant hit.

If your portfolio is well-diversified and few asset classes experience difficulties, this won’t impact the entire thing. You’ll still have other assets performing adequately enough to alleviate the decline in value. This kind of diversification is key to protecting your portfolio.

Equities

Equity represents ownership. When you purchase shares in a company, you’re purchasing ownership. For example, if Company ABC has 100,000 outstanding shares, and you buy 1,000, you will own 1% of Company ABC. As part-owner, you will have rights to a portion of a company’s profits, usually paid out to investors in the form of a dividend. The dividend amount varies by company, and some companies may use their profits to reinvest for growth.

Although stocks are lumped together, the same investing principles should not apply to them. For example, investing in a hyper-growth startup differs from investing in a blue-chip stock that’s been around for decades.

Differences in sectors can also influence the behavior of stocks. Defensive stocks, such as stocks of food companies and utilities, are goods that people always need and thus always buy. By contrast, cyclical stocks, such as luxury goods companies, tend to perform better during a strong economy when consumers have extra cash to spend. As a result, these two stock types behave differently, which will, in turn, impact your investing strategy.

Fixed-Income and Debt

Whenever you purchase an institution’s bonds, you’re essentially lending them money, which is why they represent debt. In return for this loan, the institution promises to pay interest on the loan through periodic payments. These interest payments are paid to bondholders throughout the bond’s life, and the principal is returned at the end of the term (referred to as the “maturity date”). For example, if you buy a $1,000 five-year bond with an annual interest rate of 2%, you’ll receive biannual payments of $10.

Money Market and Cash

Cash is any money in the form of local and foreign currency. This can include physical bills, coins, and cash in your bank accounts. Cash equivalents, like money market holdings, are highly liquid investments that can readily be converted into cash—usually within 90 days or less. Unlike stocks and other assets, cash equivalents must have a determined market price that doesn’t fluctuate.

Real Estate and Tangible Assets

Tangible assets—ones you can physically see and touch—are grouped into their asset class. Real estate is the most common type of tangible asset that people own, but commodities, like gold and livestock, also fall into this category. Generally, these types of assets can withstand periods of inflation.

Use All Four Classes

Having all four asset classes represented in your portfolio is not only to prevent investment downfalls but also to take advantage of the different strengths of each class. The whole theory of asset allocation is based on diversifying your portfolio by asset class; you never want to find yourself in a situation where your portfolio relies on one asset class to carry the weight. Stocks give you a chance for higher returns, but they also come with more risk; bonds don’t offer substantial gains, but they’re one of the safer investment options. It’s up to you to determine which combination of assets makes the most sense.

Note

The younger you are, the more aggressive your portfolio should be. As you get closer to retirement, your portfolio should get more conservative because you won’t have as much time to rebound in the event of a market downfall.

The Bottom Line

A portfolio with only one or two asset classes is not diversified and may not be prepared to take advantage of all the swings the market can throw at you. But diversification—or at least the degree to which you diversify—is also an individual decision that depends to some extent on your goals and risk tolerance.

If you’re particularly risk-averse, you might want to diversify even more or make sure you’re further diversified within each class, allowing for minor differences. If you have nerves of steel and you’re lucky enough to have money to burn, you might not want to rely on diversification quite as much but ride the market trends instead.

Frequently Asked Questions (FAQs)

Which of the standard asset classes is generally considered the least liquid?

Real estate is the least liquid of the most common asset classes. While stocks, bonds, and money market funds can be traded throughout the day, a real estate transaction can take weeks to close.

Which asset classes do well in inflation?

Commodities tend to do well during periods of inflation. An inflationary environment increases costs for businesses and consumers buying essential commodities like food, fuel, and building materials. Traders can invest directly in commodities through ETFs, mutual funds, and futures.