While the word “cryptocurrency” is often used as an umbrella term to describe all digital assets, there are several specific types of cryptos. Most of them fall into two main categories: coins and tokens.

Coins, or currencies, have one function: to transfer monetary value. Bitcoin (BTC) and Litecoin (LTC) are good examples of currencies.

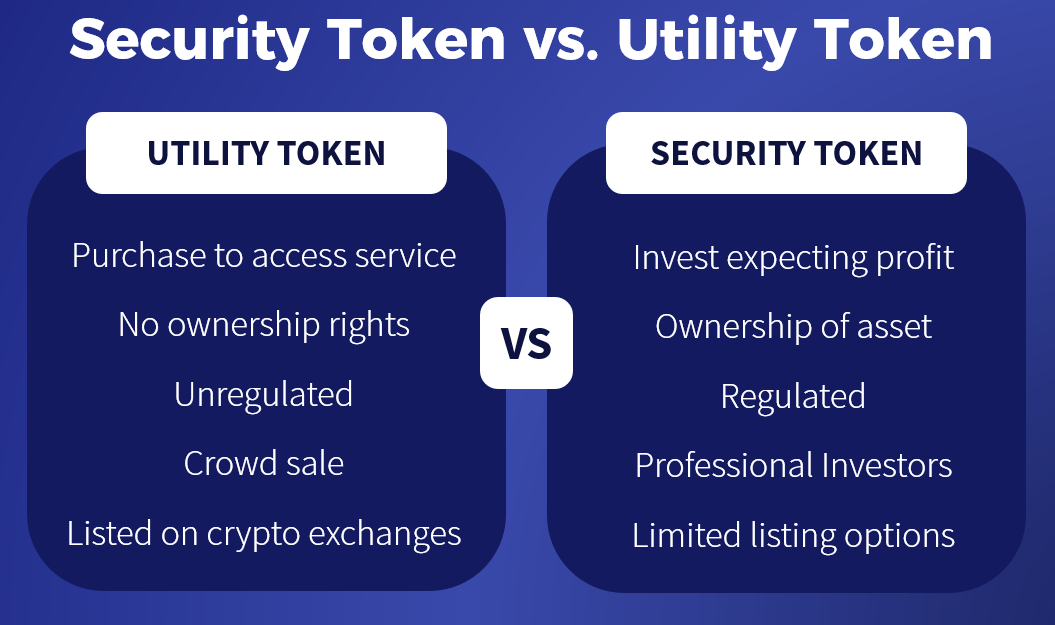

On the other hand, Tokens are a different class of cryptos entirely. Security tokens and utility tokens are the most common types.

Definition of Utility Token

A utility token is a crypto token that serves some use case within a specific ecosystem. These tokens allow users to perform some action on a particular network.

A utility token is unique to its ecosystem. For example, Brave’s Basic Attention Token (BAT) can only tip content creators through the Brave browser or other applications with integrated BAT wallets, like Twitter. BAT has no other use beyond speculating on its value. The same can be said of any utility token.

Utility tokens are not mine-able cryptocurrencies. They are usually per-mined, being created all at once and distributed in a manner chosen by the team behind the project.

Utility Token vs. Security Token

The main difference between a utility token and a security token is that security tokens give rights of ownership to a company. Think of them sort of like digital, decentralized shares of stock. Security tokens are also classified as securities by financial regulators like the Securities and Exchange Commission (SEC), making them subject to all the same rules as stocks, bonds, ETFs, and other securities.

While utility tokens are not currently classified as securities, there has been some speculation that one day, they could be. Even though these tokens are not intended to represent an investment like security tokens, that’s not what matters most to regulators. The SEC uses something called the Howey Test to determine whether or not an investment is a security.

The criteria of this test are:

- A monetary investment

- People invest because they expect to make money

- The investment is a “common enterprise,” meaning investors will only make money based on what the issuers of the investment do

- Profits are dependent on the work of a third party

If the investment checks the above boxes, the SEC considers it a security. It’s not difficult to argue that they can apply to most tokens and cryptocurrencies.

What Are Utility Tokens Used For?

A utility token can serve just about any purpose a developer wants it to. In general, utility tokens provide access to a specific service or product with a blockchain ecosystem. In other words, you might need a utility token to perform actions on an altcoin’s network.

While cryptocurrencies are a form of digital money, utility tokens might be better described as software. They can be used to transfer value, but that’s generally not their primary purpose.

To swap tokens on a decentralized exchange (DEX), or do any number of decentralized finance (DeFi) activities, users may need a specific DEX token. Alternatively, such a token could be used to reward users of the platform or to pay out interest to those who deposit funds that the platform then lends out to borrowers.

Non-fungible tokens (NFTs) also serve as a type of unique utility token. An NFT token is a one-of-a-kind digital piece of art, although NFTs can also be applied to things like music.

Utility tokens used in Initial Coin Offerings (ICOs) could even be used for malicious or fraudulent reasons. For example, during the ICO craze of 2017-18, some new blockchain projects offered utility tokens to investors with promises of great returns. In reality, the projects were fake, and there wasn’t even any new software application being built. Investors who decided to buy ICO tokens like these often had no recourse and lost everything.

Up to $100 in bitcoin2 – just for you.

With 30 coins available, our app offers a secure way to trade crypto 24/7.

Examples of Utility Tokens

Countless crypto projects have made use of a utility token. Here are a few popular utility token examples. Most of these tokens run on the Ethereum network.

Basic Attention Token (BAT)

BAT token works with the Brave browser, which is designed to be secure and private. The Basic Attention Token allows for a new advertising revenue model that does away with the need for constant tracking of user behavior. Brave users can earn BAT by opting in to view advertisements. BAT can then be used to tip content creators on their websites or on Twitter.

Chainlink (LINK)

Chainlink (LINK) is what’s known as an “oracle.” Oracles input data from an external source and upload that data to the blockchain. This can be useful for smart contract applications that need real-time price data.

0x (ZRX)

0x hopes to create a secure and fast crypto trading platform that incorporates elements of both centralized and decentralized exchanges.

Binance Coin (BNB)

Binance Coin (BNB) falls under the category of “exchange tokens,” or a token native to a specific crypto exchange’s ecosystem. In Binance’s case, users who hold BNB on the platform enjoy a 25% discount on trading fees. Instead of the fees being taken as fiat or the crypto being traded, fees are deducted from the trader’s BNB balance.

Zilliqa (ZIL)

Zilliqa is a platform for creating decentralized applications. The goal is to make these apps more affordable and secure for developers. ZIL tokens also have uses in gaming and facilitating digital advertising.

Aurora (AOA)

Aurora is a decentralized banking platform for crypto. The system runs on smart contracts. The AOA token is a stable-coin backed by endorsements, debt, and cryptocurrency reserves. There’s also a decentralized exchange.

What Are the Challenges of Using Utility Tokens?

Aside from regulatory challenges, technological and market challenges are associated with using utility tokens.

One technical challenge involves transaction fees. Because many utility tokens are ERC-20 tokens running atop the Ethereum blockchain, Ether gas fees can sometimes get very high. As more people vie for space in the next block, they bid up gas prices, making it more expensive for everyone to complete any transaction on the Ethereum network.

Like most alt-coins, utility tokens can be used as vehicles for financial speculation. Depending on the purpose of the token, this could raise issues. Suppose a specific dollar amount of tokens is required for users to do something on a network, and the dollar value of the token fluctuates wildly. In that case, users may struggle to anticipate how many tokens they need.

This is part of why some utility tokens are stablecoins, or coins designed to maintain a 1:1 ratio with another asset, most commonly a fiat currency like the U.S. dollar.

The Takeaway

A utility token is a type of token that has a specific use case. Most of these tokens are created on an existing blockchain like Ethereum — the applications used for these tokens are created using Ethereum smart contracts, and the token then runs atop the Ethereum blockchain.

Some other platforms that developers might use for similar purposes include Solana (SOL), Tron (TRX or Tron token), or the Binance Smart Chain.