If you’re new to investing, you might ask yourself, “What is an asset class?” In short, there are multiple kinds of investments; when a group of them share similar characteristics, they can be considered an asset class. One class of assets is likely to have different levels of risk and return from another class, and they are likely to perform differently in the market.

Financial advisors often try to include investments from multiple asset classes in a portfolio. That’s because portfolio diversification can help to reduce your exposure to unsystematic risk. This is the type of risk that’s unique to a specific company, industry, or place. Unsystematic risk can occur if new regulations threaten the future of a particular industry; it can also happen at a company level if, say, there is reporting of corruption within the company.

Although all investing comes with some risk, diversification in your portfolio’s asset classes distributes your money in a way that might reduce your vulnerability and mitigate unsystematic risk. There are the traditional asset classes you may have heard about already and some new additions to the list.

List of Different Asset Classes

Traditional:

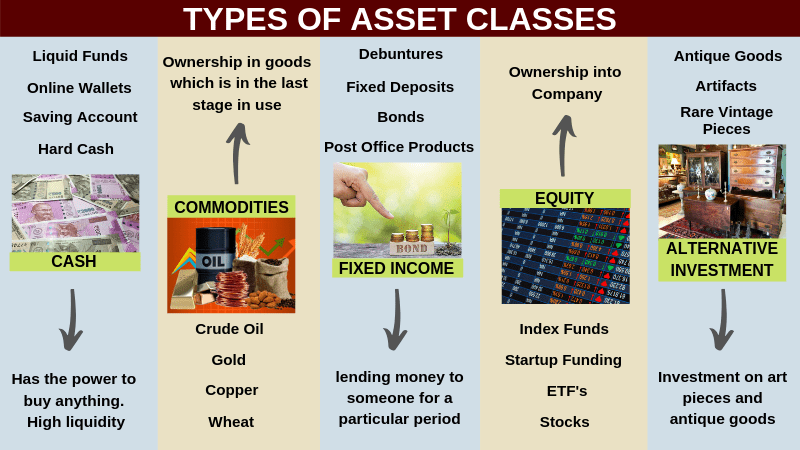

• Stocks (equities): Each share of stock is a single ownership share in a publicly-traded company, meaning a company that trades on a stock exchange. You can receive dividends from stocks if a company pays out part of its profits, or you might get capital gains when you sell if the stock price has risen.

• Bonds (fixed income): These are loans you make to a company or government for a predetermined amount of time at a certain amount of interest. These include Treasury bonds, corporate bonds, municipal bonds, and mortgage- and asset-based bonds.

• Money market accounts or cash equivalents: When you put money into a money market account, a savings account, or a certificate of deposit, you’re lending money to the financial institution, and you get paid interest on the money.

Newer additions:

• Real estate: This can involve buying real estate to rent the property to generate income or to earn profits as the value of the property appreciates. Some experts would move real estate up to the traditional asset list.

• Commodities: Some investors put money into metals, energy products, livestock, agricultural products, and so forth. A common way to do this is through a futures contract. This is an agreement to buy or sell a particular commodity at a specific quantity at a predetermined price later.

• Cryptocurrencies: This involves investing in digital currency that is largely unregulated. Typically, cryptocurrencies rely on a direct financial exchange between users, with no involvement from a bank or third party. Crypto assets are highly volatile, so investors should exercise caution before buying. If you are interested in investing in digital assets, consider opening a cryptocurrency account.

There are subgroups within these classes that have similar characteristics. Subgroups could include stocks from a specific industry, company size, or a particular kind of real estate, such as residential, commercial, or retail.

There are 11 stock sectors, such as financials, energy, technology, and so forth—and each can be further subdivided. Stocks can also be divided into those priced for growth and those selected for value. Some funds are large-cap-focused, while others focus on small or mid-sized companies. The point is that broad categories of asset classes can be divided and subdivided, creating significant options for investors.

There are also alternative types of investments:

• Real estate investment trust (REIT): REITs invest primarily in real estate or real estate loans and are traded like stocks.

• Gold: You can invest in gold and other precious metals directly by buying the metal as coins or bars or using exchange-traded funds (ETFs) that invest in bullion.

• Peer-to-peer investing: New regulations have made it easier for private companies to raise money from individual investors.

Sometimes, it can be challenging to pigeonhole an asset precisely. For example, exchange-traded funds (ETFs) can defy precise classification. ETFs are traded on exchanges, which makes them similar to stocks, but ETFs can contain investments from multiple asset classes, which puts them into a category all their own. Investors must know what investments are in the ETF’s holdings to allocate them appropriately.

Plus, some financial analysts consider domestic investments to be in a different asset class from foreign ones. Fortunately, you don’t have to be able to classify each asset into a hard and fast class to invest in them as part of your diverse portfolio.

Which Asset Classes Are Right for You?

It depends. Considering which asset classes you should invest your money in might help to consider your unique goals.

Goals-based investing is an investment approach that, rather than looking at marketing benchmarks, focuses on what you need your money for and when you’ll need your money. Different investment strategies allow you to plan for different goals (retirement, house down payment, kids’ college). You may also hear it called goals-driven investing. Knowing your short-term and long-term goals is vital to invest, according to this philosophy.

The decision you make on which asset classes you want in your portfolio isn’t a final one.

Traditional investment strategies measure risk tolerance and look at portfolio returns. Using that information, you’d decide how to invest and what your portfolio should look like.

Remember that deciding which asset classes you want in your portfolio isn’t the final one. Things change, and so can your portfolio.

Your portfolio could include investments in multiple asset classes, each with its levels of risk and return. Over time, assets have returns and losses, meaning each asset’s value changes.

Portfolio rebalancing is part of investing and means adjusting your investments—i.e., making changes to them so asset allocation continues to fit your goals and risk tolerance. Rebalancing also allows you to review your portfolio and ensure it’s still where you want to invest.

Where Should One Start?

How you should invest typically depends on factors, including your personality, risk tolerance, and how actively you want to be involved.