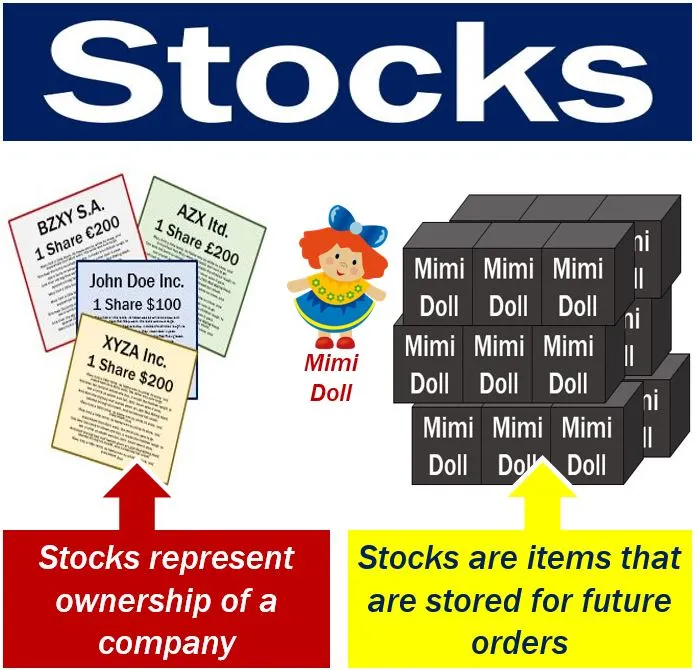

Stocks are units of ownership in a company, also known as shares of stock or equities. When you buy a share of stock, you’re purchasing a partial ownership stake in a company, entitling you to certain benefits. Understanding what stocks are and how they work is one of the keys to investing since stocks play a central role in building a well-balanced investment portfolio.

What Is a Stock?

Companies raise capital to fund their operations by selling shares of stock. When companies sell a stock, they invite investors to purchase a fractional ownership interest in the company, making them part owners. “Equity” is a way to describe ownership, and “equities” are an alternative name for stocks. Companies can also issue bonds to raise capital, although buying bonds makes you a creditor without any ownership stake in the company.

When you buy shares of stock in a company, you gain certain privileges depending on the types of shares you own, including:

- Voting rights: You may have the right to vote at the company’s annual shareholder meetings.

- Dividends: You may receive a share of the company’s profits.

- Capital appreciation: When the company’s stock price goes up, your shares increase in value (and when the price of a stock declines, the value of your shares falls).

While stocks give you an ownership share in a company, owning shares of stock doesn’t mean you’re entitled to a say in the company’s day-to-day operations. Owning stock means trusting the company’s leaders to run the business how they see fit. If you don’t like a company’s performance, you sell your shares and choose a new home for your investment dollars.

Stocks and Initial Public Offerings

When private companies decide to sell shares of stock to the general public, they conduct an initial public offering (IPO). When you read that a company is “going public,” that means they are conducting an IPO where they make shares available for purchase by investors via public stock markets.

During an initial public offering, the company and its advisors disclose how many shares of stock will be issued and set an IPO price. Funds raised from stock sales during an IPO go directly to the company. Once the offering is complete, the shares of stock are traded on the secondary market—otherwise known as “the stock market”—where the stock’s price rises and falls depending on a wide range of factors.

What Are the Different Types of Stock?

Companies issue a variety of different types of stock. Common stock and preferred stock are among the most common varieties, and some companies have different classes of stock. These types of stock determine voting rights, dividend payments, and your rights to recoup your investment if the company is bankrupt.

Common Stock vs. Preferred Stock

As noted above, buying stocks may give you the right to vote on issues at a company’s annual shareholder meeting.

Each share of common stock typically gives holders a single vote at the company’s annual meeting. However, common stock shareholders are at the end of the line after debt-holders, creditors, and preferred stock shareholders recoup their investments should the company go bankrupt. Common stock generally entitles you to dividends. However, you are not guaranteed to receive dividend payments. Companies can choose to pay or not pay dividends depending on their needs.

Shares of preferred stock typically do not give you any voting rights, although preferred stock generally entitles holders to receive dividend payments before common stockholders. In addition, investors who own shares of preferred stock are ahead of those who own common stock in line for recouping their investment should the company go bankrupt.

Different Classes of Stock

Companies frequently issue different classes of stock, often designated with a letter, such as A, B, or C. Additional share classes are typically issued with specific voting rights per class and exist to help company founders or executives retain greater control over the company.

Take Alphabet, the holding company that owns Google. Alphabet has three classes of stock. Class A stock (GOOGL) gets one vote for each share. The company’s founders hold class B stock and get 10 votes per share. Class B shares are not publicly traded and exist to help the founders retain control over the company. Class C stock (GOOG) has no voting rights and is primarily held by employees and some common shareholders.

Types of Dividends

Depending on the type of stocks you own, companies may share their profits with you via dividends. Investors receive dividend payments quarterly or annually, with payments allocated based on how many shares of the company’s stock you own. Preferred stock holders prioritize claiming dividends ahead of common stock shareholders. Regardless of your stock type, the principles governing dividends are essentially the same.

For example, a company has positive quarterly earnings and issues a $0.42 preferred stock dividend. If you own 100 shares of the company’s preferred stock, you’ll receive a cash dividend of $42. Many companies also offer a dividend reinvestment plan (DRIP) that allows you to reinvest your cash dividend payments into the stock, expanding your holdings and keeping your cash hard at work in your portfolio.

Companies sometimes issue stock dividends. If a company declares a stock dividend of 5% and holds 100 shares of that company, you’d receive five additional shares of stock, bringing your holdings to 105 shares. However, the value of each outstanding share would decrease by 5%, making the value of your shares the same.

Companies also issue hybrid dividends that are a combination of cash and stock. Hybrid dividends are rare but have been used by companies to share profits with their shareholders.

Why Own Stocks?

Owning shares of stock gives you the potential to share in the profits of the world’s most successful companies. The S&P 500, one of the most common indexes that track stock performance in the U.S., delivered investors a 7% average annual rate of return, adjusted for inflation, from 1959 to 2009. Compared to Barclay’s U.S. Aggregate Bond Index, which has returned an average of 4.67%, stocks outperform fixed-income investments over the long term.

While buying them isn’t without risk, investors use stocks as one of the core tools to grow their savings and plan for long-term financial goals like retirement and educational savings. As stock prices go up, so does your savings balance. But be aware that stock prices also go down, sometimes losing all of their value and becoming worthless. There’s no guarantee that you’ll recoup your investment.

Stocks are one of the primary ways to diversify an investment portfolio. Investors buy different stocks in large and small companies in various industries to help mitigate risk, as different sectors of the economy thrive at different times. For example, a company selling paper products might experience record sales during an economic crisis like COVID-19, whereas an automaker might have below-average sales performance. Owning various stocks can help investors enjoy gains in thriving sectors while offsetting losses in others.

The Difference Between Stocks and Bonds

Both stocks and bonds are complementary in building a diversified investment portfolio. Buying stocks and bonds helps investors capture market gains and protect against losses in various market conditions.

Take a look at both side-by-side to help better understand the difference between stocks and bonds:

| Stocks | Bonds | |

|---|---|---|

| What are they? | Fractional ownership of a company | A fractional interest in a company’s debt |

| How do you make money? | Capital appreciation and dividends | Regular interest payments |

| What are the risks and returns? | Generally more risk, in exchange for higher returns | Generally lower risk, in exchange for more limited returns |

If you’re looking for long-term growth, having more stocks in your portfolio could be a good strategy, given their historically high rates of return compared to bonds. As the economy grows, public companies grow their revenue and profits, which causes the value of their shares to rise over the longer term, and their shareholders reap the benefits.

Investing more in bonds might be a better approach if you are looking for a steady income. While bonds may have lower long-term rates of return than stocks, a well-chosen portfolio of bonds offers reliable interest payments and lower volatility. The latter is attractive for investors who might be nearing or in retirement and want to preserve capital after their years in the workforce are over.

Note: ZPEnterprises is not a licensed investor/financial advisor, but we are trying to share awareness of financial topics. Please do further research and work with a licensed financial advisor.